Elder abuse can be more than physical abuse or neglect. Financial exploitation is a common—and harmful—form.

According to a press release from American Senior Communities, seniors lose over $5.9 billion each year to identity theft, promises of goods or service, scams such as posing as a family member in need, and more.

American Senior Communities partnered with the U.S. Attorney’s Office for the Southern District of Indiana to host educational sessions informing people of common scams and how to avoid them. A list of upcoming public sessions can be found here.

Adam Eakman, assistant United States attorney, presents common scams and how to avoid them during the ASC events.

“When targeting the elderly, all the scams try to get the victims to make a decision out of emotions rather than logic or reasons,” Eakman said. “So all the scams either target some strong emotion like love, greed or fear.”

The Department of Justice has an elder justice site that states the difference between financial abuse and financial fraud, both of which are forms of financial exploitation.

Financial abuse could be a family member using money meant for care costs on their own expenses. Trusted business professionals such as an accountant can also commit financial abuse by unauthorized use of personal funds.

Financial fraud occurs when strangers deceive older people. This may be someone pretending to be a romantic interest asking for money, a stranger posing as a family member in need of money, or phishing emails, texts and calls asking for personal information to gain access to funds.

Eakman said in one common financial fraud scam, individuals make fake profiles to start an online relationship with older people.

“They might create a profile on Facebook or something like that in which they start to create somewhat of a relationship online. Maybe it’s a few weeks, a few months, but they don’t actually meet because it’s a scam,” Eakman said.

“Eventually that person will say, ‘Oh, my aunt is in the hospital and needs money. She has an important surgery,’” Eakman said. “That’s targeting love in the sense that they think they really know this person, so they’ll send them money, when really, instead of being like a 70-year-old person living in Texas, it’s a 20-year-old person living in India.”

He added other scams target hope—maybe stating people have won a fake sweepstakes or lottery. Fear-based scams may be fake calls where a stranger pretends to be someone’s grandchild in need of bail money.

The Office for Victims of Crime site states fraud and romance scams aimed at older adults resulted in losses of more than $184 million in 2018. Many crimes go unreported because victims are scared, embarrassed or don’t know who to call.

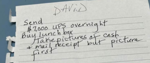

Kelly Partin Plainfield says her elderly mother has been a victim of financial exploitation. Partin submitted a photo of the instructions “David” gave her mother to send him money. Her mother often wrote the instructions given over the phone down in her notebook.

Kelly Partin, 54, of Plainfield, has watched her elderly mother fall victim to multiple scams over the past few years. These scams began through Facebook profiles building relationships with her mother, then eventually asking for money. She and her siblings have worked tirelessly to stop the financial losses.

“Upwards of $350,000 lost to scammers,” Partin said. “We’ve been to the police, Social Security office, Adult Protective Services, the banks, a lawyer, and nothing has worked.”

Despite reporting the fraud, Partin said her mother has continued to be taken advantage of by the fake profiles as she believes she is truly helping them. She said the scammers use loneliness as a way to manipulate older people.

“Stay deeply involved with your family. Be more involved in our elders’ communities’ lives,” Partin said. “They’re sitting at home alone, and there’s people that are preying on that. They’re preying on that loneliness.”

The cost of financial scams is often more than monetary. Older people can experience emotional and physical symptoms as a result of being scammed, especially feelings of shame. The DOJ has a roadmap to help in the reporting process.

Partin hopes by sharing her family’s story others may become more aware of the severity of these scams. She wishes there was more she could do to protect her mom and rebuild their relationship.

“I had to cut her out of my life because it was detrimental to my mental health. I can’t trust her. It has left scars,” Partin said. “I want to forgive her and be in her life because she is my mother, but she is desperate for money for these men.”

Eakman said his No. 1 piece of advice to avoid any scam is to slow down and consider discussing the situation with a trusted friend or family member.

“Scammers want you to hurry up and send money. ‘He’s going into jail now, they’re going into surgery now, you’ve won the lottery and you’ve got to claim it now, act now or your account will be closed, you have for 24 hours or your account will be closed,’” Eakman said. “They want you to act fast. So that’s when anyone who sees that or is told that should slow down. Take a day, take two days to think about it.”

If you or a loved one believes they are experiencing elder fraud, contact the National Elder Fraud Hotline at 833-373-8311.